- Community

- Topics

- Community

- Topics

- Community

- :

- Discussions

- :

- Taxes

- :

- Get your taxes done

- :

- TurboTax Not Giving Me Enough Options to describe my 1099-NEC

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

TurboTax Not Giving Me Enough Options to describe my 1099-NEC

Hi,

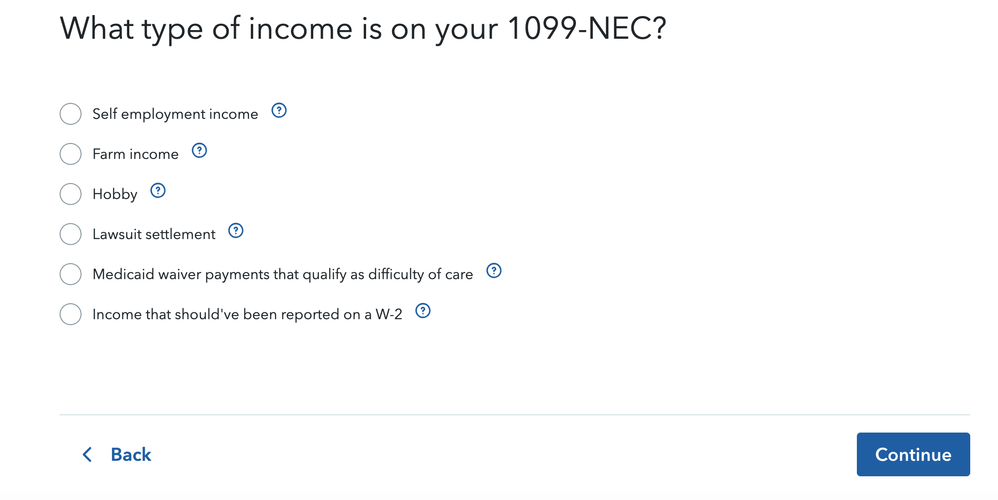

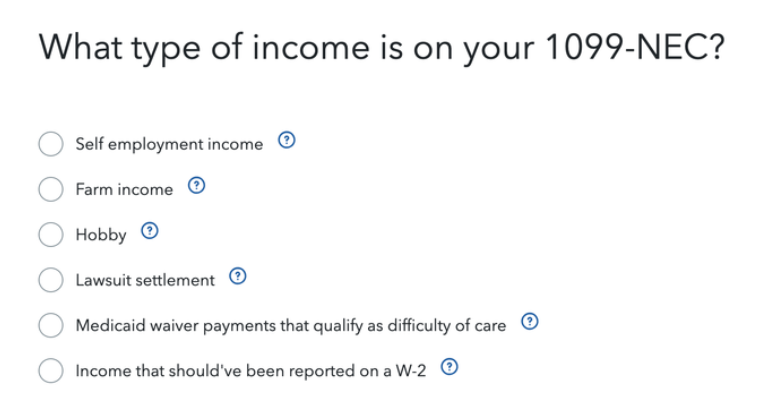

I received a 1099-NEC for a one-time honorarium I received it as a "fellowship" but I did *not* provide any services nor was I required to do any work, I simply attended a conference. I believe I should report this on Schedule 1 on either line 8r "Scholarship and fellowship grants not reported on Form W-2" or 8i "i Prizes and awards." However, TurboTax software is only giving me limited options for how to classify this, as seen below. How do I get TurboTax to classify this on a more accurate line 8 on Schedule 1?

Do you have an Intuit account?

You'll need to sign in or create an account to connect with an expert.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

TurboTax Not Giving Me Enough Options to describe my 1099-NEC

Report this scholarship income under Education expenses. You will answer questions as if you will report education related expenses.

In TurboTax Online, follow these steps:

- Down the left side of the screen, click on Federal

- Down the left side of the screen, click on Deductions & Credits.

- Scroll down to Education. Click the down arrow to the right.

- Select Start / Revisit to the right of Expenses and Scholarships.

- Under Your Education Expenses Summary, click Edit.

- You may have to cycle through several questions about the student, the school and the student's IRS form 1098-T.

- You will arrive at the screen Scholarships and Financial aid. Click Continue.

- At the screen Did you Receive a Scholarship or Grant in 2023?, select Yes.

- There will be several other questions about your educational expenses.

The entry will be reported:

- on line 8r of Schedule 1 of the Federal 1040 tax return, and

- on line 8 of the Federal 1040 tax return.

**Mark the post that answers your question by clicking on "Mark as Best Answer"

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

TurboTax Not Giving Me Enough Options to describe my 1099-NEC

Thank you so much. Unfortunately, this isn't working for me. It just says I'm not eligible, and no "scholarships and financial aid" screen comes up.

Could I just not enter it as a 1099-NEC and instead report it as "other taxable income" under "less common income" in Wages and Income?

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

TurboTax Not Giving Me Enough Options to describe my 1099-NEC

Yes, report this as less common income>other reportable income. Describe it as 1099 NEC scholarship income.

**Mark the post that answers your question by clicking on "Mark as Best Answer"

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

TurboTax Not Giving Me Enough Options to describe my 1099-NEC

OK whew. Thank you so much for your help!

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

TurboTax Not Giving Me Enough Options to describe my 1099-NEC

I have the same issues. I have a 1099-NEC that is from a one time honorarium. I need to list it as other income, but Turbotax does not give this as an option. How can I do this?

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

TurboTax Not Giving Me Enough Options to describe my 1099-NEC

To enter a Form 1099-NEC that is not for self-employment:

Open your return and go to Federal >> Wages & Income >> Other Common Income >> Income from Form 1099-NEC. Click Start/Update.

Or enter 1099-nec in the Search box located in the upper right of the program screen. Click on Jump to 1099-nec.

- On the screen Did you get a 1099-NEC?, click on Yes

- On the screen Do You Want to Enter Your 1099-NECs Now?, click on Add a 1099-NEC

- On the screen Let's get the info from your 1099-NEC, enter your information and click Continue

- On the screen Describe the reason for this 1099-NEC, enter a reason "Honorarium" and click Continue

- On the screen Does one of these uncommon situations apply? Select This is not money earned as an employee or self-employed individual, it is from a sporadic activity or hobby and click Continue.

These entries will report the income on Schedule 1 Line 8z Other Income. The total from Schedule 1 Line 10 flows to Form 1040 Line 8 as ordinary income.

**Mark the post that answers your question by clicking on "Mark as Best Answer"

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

TurboTax Not Giving Me Enough Options to describe my 1099-NEC

Thank you for the message, but unfortunately what you described does not work with the online software. You must be describing the downloadable software. As the person who initiated this thread states, TurboTax only gives the following options for type of income on a 1099-NEC:

I am forced to choose one of these options, even though none of these fit my situation. Should I just choose hobby since it is a one time sporadic income activity? Thank you.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

TurboTax Not Giving Me Enough Options to describe my 1099-NEC

Yes, you can check Hobby on that screen in TurboTax Online. In the Desktop software, the checkbox says from a sporadic activity or hobby, and even though it's not spelled out like that in the online version, what winds up being reported on your tax return is the same thing. Your income will be reported as Other Income, and will not be treated as Self-Employment Income.

**Mark the post that answers your question by clicking on "Mark as Best Answer"

Still have questions?

Make a postGet more help

Ask questions and learn more about your taxes and finances.

Related Content

fillini00

Level 2

enjolras49

Level 1

david-r-mullinax

Level 3

Zeynep

New Member

mgt7

Level 2