- Community

- Topics

- Community

- Topics

- Community

- :

- Discussions

- :

- Taxes

- :

- State tax filing

- :

- Re: Adjusting federal pension income for Oregon return

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Adjusting federal pension income for Oregon return

Do you have an Intuit account?

You'll need to sign in or create an account to connect with an expert.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Adjusting federal pension income for Oregon return

Go back to the Federal section of the program.

- Select Income & Expenses

- Select "IRA,401(k), Pension Plan Withdrawals (1099-R)

- Select "Edit" under the appropriate 1099-R form

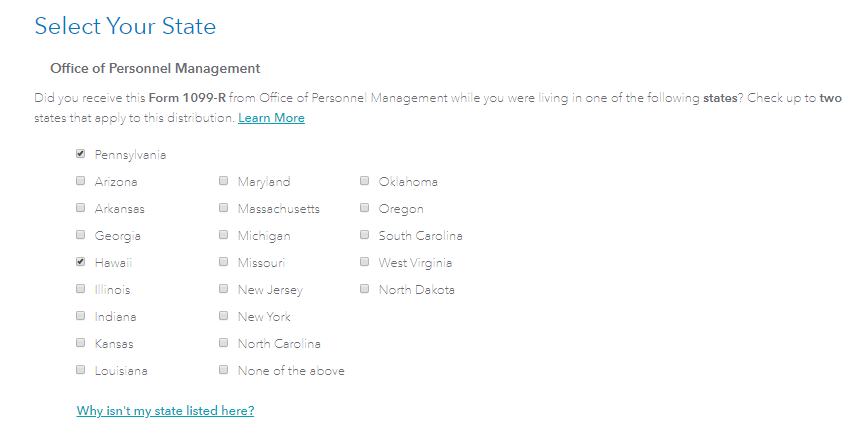

- Proceed to answer through the screens until you see "Select Your State". (You should see this after enter your details from the 1099-R, and the question asking if you are a public safety officer.

Be sure you select Oregon in the section above.

**Mark the post that answers your question by clicking on "Mark as Best Answer"

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Adjusting federal pension income for Oregon return

Is this for 2018 form OR-40 line 13? Where you put information from Schedule OR-ASC? From Section 2: Subtractions (codes 300 - 360)???????

I can't make it work for the code 307, I hope this is the fix.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Adjusting federal pension income for Oregon return

There was NOT a select your state option, it just listed Oregon and that

"TurboTax will ask about months of service when completing your Oregon return"

which it DID NOT DO!!!!

I had to file Oregon taxes by hand, thanks, Turbo "problem causer" Tax

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Adjusting federal pension income for Oregon return

HERE'S what to do.

Follow above, WAY above, and go to

"IRA and Pension Distributions"

and hit EDIT. When you get to

"Federal Pension Summary"

Hit edit and it takes you to

"Report Service Dates"

If you're e reservist like me, I hope you have all your points counted for before and after Oct 1, 1991. SO, when you get to

"Do You Have Subtractions from Federal Income?"

"Do you have any of these subtractions (or others not listed)?"

Hit YES you get popped over to

"Your Subtractions from Federal Income"

Check the box for

"If you have a subtraction to Oregon income that you haven't already entered, check this box" and click continue.

It you click the highlighted 'subtraction', it gives you the codes. 307 for federal pension in my case.

The dollar amount from the points page should be there.

When you get to

"Retirement Income Credit-Household Income"

Don't enter your military retirement income again by mistake.

Good Luck. If it still doesn't work, call and say OTHER or whatever to get a person, you WILL get a person eventually. The one I got was VERY helpful.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Adjusting federal pension income for Oregon return

I am not sure I am correct, but after working on this thing for the past two hours I did the following:

When entering the Federal Retirement data, I simply entered the amount in line 1 or 2a and entered it into line #16. When you get to the Oregon return Turbo Tax automatically asks for the computation deduction data.

Good luck!

Still have questions?

Make a postGet more help

Ask questions and learn more about your taxes and finances.

Related Content

Tina1828

Level 1

winter_s

New Member

nareshkumar.ks

New Member

TXW

Returning Member

Eddie 3

New Member