- Community

- Topics

- Community

- Topics

- Community

- :

- Discussions

- :

- Taxes

- :

- Investors & landlords

- :

- Re: Sold duplex that was both home and rental with several renovations over the years, but not su...

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Sold duplex that was both home and rental with several renovations over the years, but not sure how to treat sale in TurboTax

In 2006 I purchased a duplex for $97k and sold in October, 2020 for $150k. Over the years there have been many renovations. 1st floor was rented and 2nd floor was my home/primary residence.

In Dec 2017 I moved and rented the 2nd floor. Before Dec 2017 I had the duplex listed as one property in TurboTax and was just deducting 50% for the rental side. But for 2018 I had a dilemma because I couldn't do it that way anymore, so I converted the duplex into two properties for TurboTax.

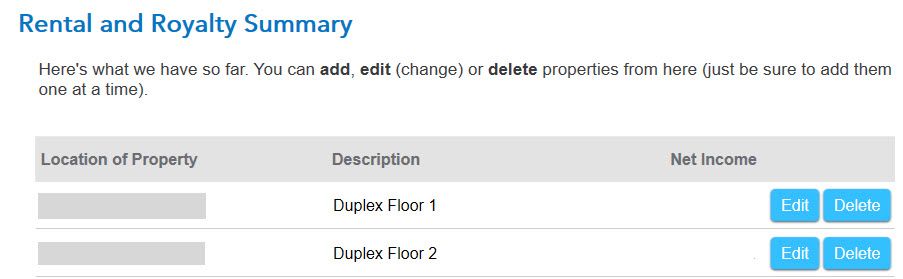

So, in TurboTax, I have them treated as two separate properties:

Duplex 1st Floor – rented from 2006 – Oct 2020.

Duplex 2nd Floor – primary residence from 2006 – Dec 2017. Rented Jan 2018 – Oct 2020.

Since I lived in "Duplex 2nd Floor" 26 months out of the last 5 years, I can count it as a sale of my primary residence.

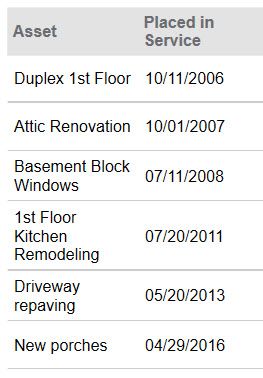

I have the following assets listed in TurboTax for each side of the duplex.

Duplex 1st Floor:

Duplex 2nd Floor:

I have several questions:

I have a 1099-S from the sale, but where do I enter it?

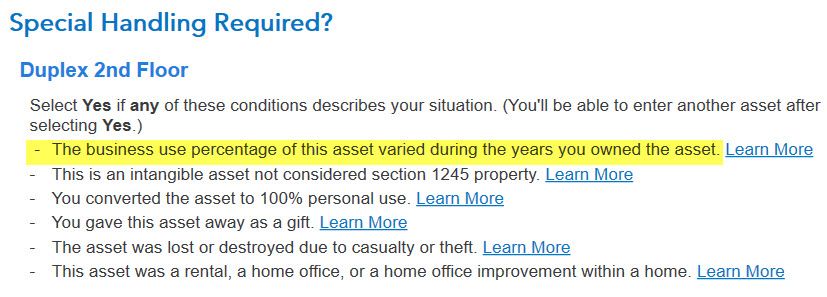

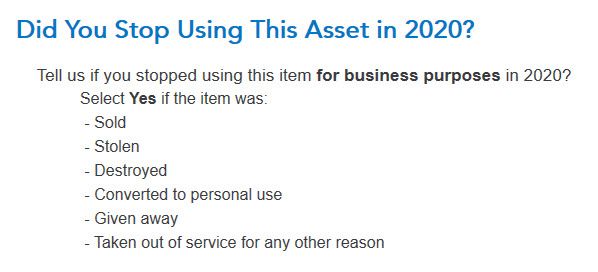

I am stumped by this question:

Do I answer "Yes" or "No" to the above? Does this apply to my situation? Only the yellow highlighted condition might apply?

I didn't even have "Duplex 2nd Floor" listed in TurboTax until I moved in 2017. From 2006-2017 it was my primary residence, so 0% business use. Then 2018-2020 it was 100% business use. Not sure how to answer the above question.

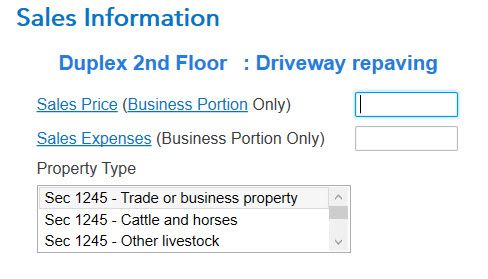

How do I deal with the "sale" of the renovations, both for the Duplex 1st Floor that was always rented and for the Duplex 2nd Floor that was once my primary residence and then converted to 100% rental last 2 years 10 months?

For example, I don't know how to answer this for Duplex 2nd Floor (that was always a rental):

What would I enter as the sales price for the renovations?

I only have one sales price as it appears on the 1099-S -- $150k for the entire duplex. I used 1/2 this sales price for each asset, $75k for Duplex 1st Floor and $75k for Duplex 2nd Floor.

Is that correct, or should it be entered differently?

Any help is greatly appreciated!

Dave

Do you have an Intuit account?

You'll need to sign in or create an account to connect with an expert.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Sold duplex that was both home and rental with several renovations over the years, but not sure how to treat sale in TurboTax

1) Regarding the question about business use varying, you would answer no. The blue Learn More link says:

If the business use percentage varied over the life of the asset, the program cannot automatically compute the sale information.

For the conversion, you want to make sure you answer this screen properly. This will give the program the correct information.

2)The easiest way to deal with the sale of renovations is to stop treating them as separate property. You received $150,000 for the entire property, improvements included, so make the sales price zero.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Sold duplex that was both home and rental with several renovations over the years, but not sure how to treat sale in TurboTax

Okay, thanks!

I'll enter $0 for the sales price on all the renovations.

However, I have not come across the question "have you used this item 100% for this business since you acquired it?" I separated the duplex to two properties on 2018 taxes, when we started renting out our unit. Is that when this question would have been asked? Is there any way I can check on 2020 TurboTax and, if I answered wrong, correct it?

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Sold duplex that was both home and rental with several renovations over the years, but not sure how to treat sale in TurboTax

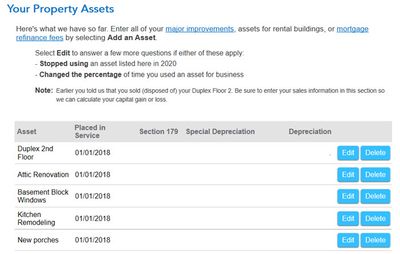

You would need to answer yes to the rental side and no with further answers on the conversion. The questions are at the bottom of this screen.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Sold duplex that was both home and rental with several renovations over the years, but not sure how to treat sale in TurboTax

Sorry, I simply can't figure out where the screen "Tell Us More About This Rental Asset" is or how you got there. :( At first it looked like you might be adding a new asset, but I walked through those step-by-step questions and it was not there.

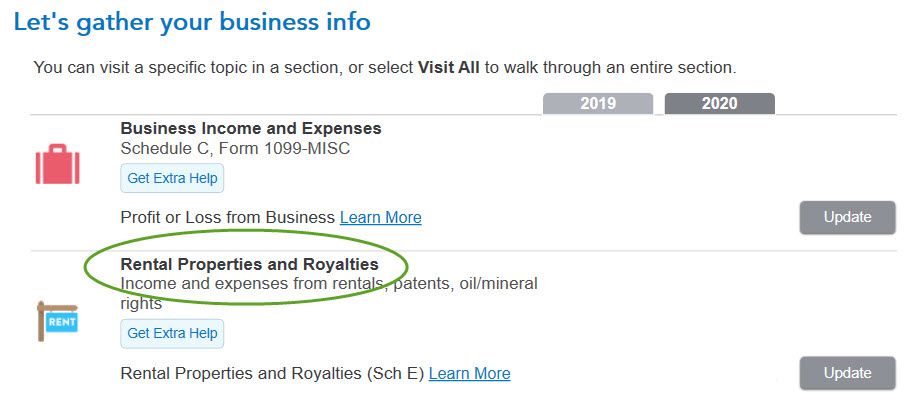

Would this question be asked from Rental Properities and Royalties?

And then

And then when I click Edit, I eventually get to this question:

This is simliar in wording to your screen, but when I answer "Yes", it just prompts for the sales information.

Do I need to be somewhere else in TurboTax's step-by-step screens? Where will I find the "tell us more about this rental asset" screen?

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Sold duplex that was both home and rental with several renovations over the years, but not sure how to treat sale in TurboTax

No, however you must click edit next to each asset and the instructions below may be helpful.

Follow the instructions below.

- Click on Income & Expenses

- Under Your income and expenses, scroll down to Rental properties and royalties, click Edit/Add

- Do you want to review your rental?, click Yes

- Under Rent and Royalty Summary, click Edit

- Click Update to the right of Assets/Depreciation.

- Do you want to go directly to your asset summary?, click Yes and Continue

- Click Edit to the right of the assets to be disposed

- Go through several screens until you get to Tell Us More About This Rental Asset

- Click on This item was sold……. (image in earlier thread)

- And continue to answer the questions

See also here.

You can use the information provided to allocate selling price to the original structure and zero for the renovations.

**Mark the post that answers your question by clicking on "Mark as Best Answer"

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Sold duplex that was both home and rental with several renovations over the years, but not sure how to treat sale in TurboTax

Thank you, Diane. I am following all your steps right up to Step 8 when it appears that what I see is not the same. I am using TurboTax Home and Business 2020.

Starting from your Step 5:

5. Click Update to the right of Assets/Depreciation.

6. Do you want to go directly to your asset summary?, click Yes and Continue

7. Click Edit to the right of the assets to be disposed

When I click "Edit" on "Duplex 2nd Floor", I scroll through the following screens (there is never a Tell Us More About This Rental Asset screen).

Review Information

Did You Stop Using This Asset in 2020 (Yes)

Disposition Information (I enter sold date 10/14/2020)

Special Handling Required? (No)

Home Sale (Yes)

Was the rental portion a separate dwelling? (No--it was our primary home up to Dec 2017 and then rented)

Ownership and Address of Home Sold (I enter info)

Sales Information (I enter info, $75k, 1/2 sales price of entire duplex)

Time You Lived In Your Home (Yes--lived at least 24 months in past 5 years)

Did You Use This Home for Anything Other Than Your Primary Home (No)

Another Home Sale (No)

How Did You Buy the Home? (No)

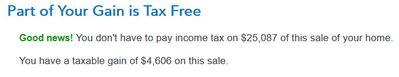

Then I see the screen:

Do those screen make sense? I never see the Tell Us More About This Rental Asset screen.

Also, I don't understand why I am paying tax on $50k of the sale and only get a tax break on $25k.

Is this because I split the duplex into two properties for TurboTax 2018, or because I rented it 2018-2020? I thought the primary residence portion would be tax-free.

Does any of this make sense?

And since I'm not getting the Tell Us More About This Rental Asset screen, I'm just wondering if something is not set up correctly. :(

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Sold duplex that was both home and rental with several renovations over the years, but not sure how to treat sale in TurboTax

Yes, the reason that $50k of the sale is subject to tax, and only $25k gets a tax break is because the rental was a primary residence until 2017 and then rented. Since the asset was "placed in service" after September 27th, 2017, it appears that you are getting 50% depreciation.

Still have questions?

Make a postGet more help

Ask questions and learn more about your taxes and finances.

Related Content

bruced63

New Member

user483784620

New Member

sunshinebabycakeswells

New Member

USM Professor

Level 1

JMB011

New Member