- Community

- Topics

- Community

- Topics

- Community

- :

- Discussions

- :

- Taxes

- :

- Business & farm

- :

- Re: Entering Animals as Assets

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Entering Animals as Assets

I have seen multiple questions but no answers that apply to our situation. We have a business that imports/exports and breeds reptiles. How do we enter breeders we purchase as an asset? Similar to other questions I have seen, there is no asset choice that animals fall under. We are an LLC, so it isn't a hobby. We are not a farm so it doesn't fall into the farming and breeding. Last year we simply expensed them and included them as inventory but are thinking we need to not include our breeders in inventory anymore. Any help is appreciated.

Do you have an Intuit account?

You'll need to sign in or create an account to connect with an expert.

Accepted Solutions

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Entering Animals as Assets

Livestock held for breeding purposes can either be included in inventory or depreciated as the breeder chooses. Both options have advantages and disadvantages, so the decision is ultimately based on whether breeders prefer a current benefit or future benefit.

If breeders choose to depreciate the livestock, they will receive a current depreciation deduction. However, this will decrease the farmer’s basis in the livestock and therefore increase any gain when the livestock is sold.

Also, any future gain on a sale up to the amount of depreciation taken will be taxed at ordinary rates. If, on the other hand, breeders choose to inventory the livestock, they will forego the current depreciation deduction but any future capital gain will be taxed at the lower and more preferable capital gain rates.

Breeders should consider this decision and its impacts carefully, because once a method is chosen, it cannot be changed unless authorized by the Commissioner.

If the cost of each individual asset is $2,500 or less, you can expense them under the De Minimis Safe Harbor Election.

If you expense them, you would not include them in inventory. When you sell them you would treat it as the sale of an asset.

You may depreciate or section 179 "livestock", which includes snakes. Snakes not falling into any of the specific agricultural categories, you should use the actual expected lifespan of the animal for the depreciation period.

**Mark the post that answers your question by clicking on "Mark as Best Answer"

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Entering Animals as Assets

Livestock held for breeding purposes can either be included in inventory or depreciated as the breeder chooses. Both options have advantages and disadvantages, so the decision is ultimately based on whether breeders prefer a current benefit or future benefit.

If breeders choose to depreciate the livestock, they will receive a current depreciation deduction. However, this will decrease the farmer’s basis in the livestock and therefore increase any gain when the livestock is sold.

Also, any future gain on a sale up to the amount of depreciation taken will be taxed at ordinary rates. If, on the other hand, breeders choose to inventory the livestock, they will forego the current depreciation deduction but any future capital gain will be taxed at the lower and more preferable capital gain rates.

Breeders should consider this decision and its impacts carefully, because once a method is chosen, it cannot be changed unless authorized by the Commissioner.

If the cost of each individual asset is $2,500 or less, you can expense them under the De Minimis Safe Harbor Election.

If you expense them, you would not include them in inventory. When you sell them you would treat it as the sale of an asset.

You may depreciate or section 179 "livestock", which includes snakes. Snakes not falling into any of the specific agricultural categories, you should use the actual expected lifespan of the animal for the depreciation period.

**Mark the post that answers your question by clicking on "Mark as Best Answer"

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Entering Animals as Assets

Thank you so much for such a thorough explanation. Your answer makes me wonder if our income from breeding would be "farm income" and income from reselling imports would be just regular income. I've never thought of any of our business as farming.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Entering Animals as Assets

I'm not all that knowledgeable on the farming aspect. but I do know that breeding livestock is considered a form of farming by the IRS and is therefore reported on SCH F. Overall, you may wish to seek professional help if this is your first year dealing with this. That way you can make "educated" decisions on the best path to chose for your specific situation. Otherwise, you risk regrets that you flat out can not undo "at" "any" "cost" in the future. So the cost of professional help for the first year would probably be well worth it.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Entering Animals as Assets

You don't have to plant something in the ground to be a farmer ... think of fish farms for example.

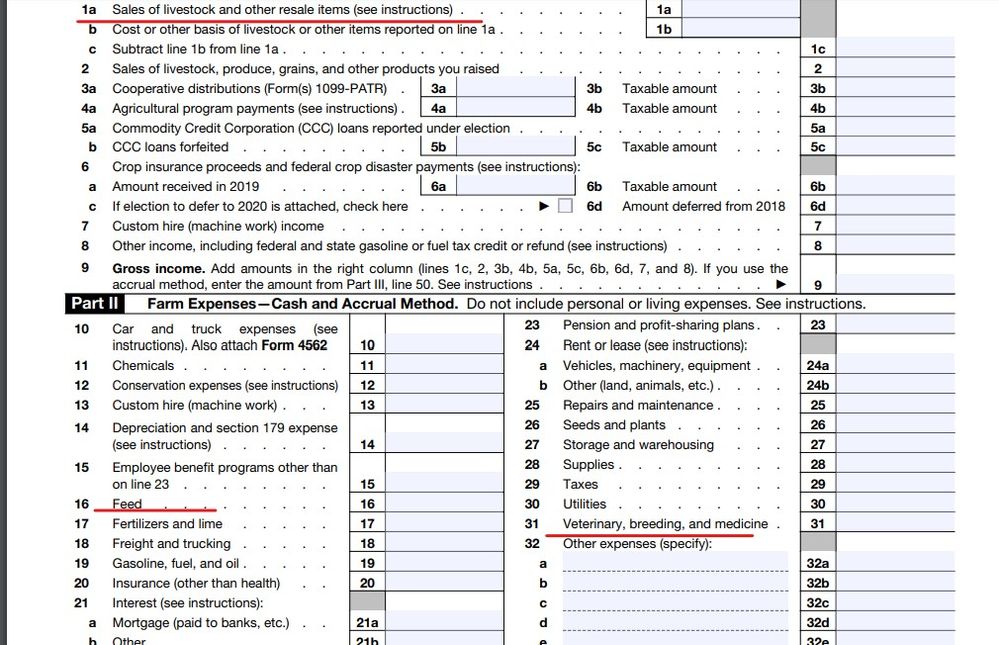

If you use the Sch F instead of the Sch C there are different categories of expenses listed more suited to your business ... look at a Sch F to see what I mean ... you can use either form since they will both do the same things in the long run. https://www.irs.gov/pub/irs-pdf/f1040sf.pdf

Still have questions?

Make a postGet more help

Ask questions and learn more about your taxes and finances.

Related Content

dmarchello

New Member

ddubs82

Level 2

bhuether

Level 3

steiny1227

Level 3

steveruggles1

New Member