- Community

- Topics

- Community

- Topics

- Community

- :

- Discussions

- :

- Taxes

- :

- Deductions & credits

- :

- Re: Please see the screenshot I added to my original answer....

Do you have an Intuit account?

You'll need to sign in or create an account to connect with an expert.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Do we pay tax on forfeited dependent care FSA?

Forfeited amounts are not taxed; however, if there is an amount not used for Dependent Care, it becomes taxable income. The purpose of the account is to set aside pre-tax money to be used for child care. It loses its pre-tax qualification if it is not used for that purpose.

[edited | 3.17.23 | 7:56am]

**Mark the post that answers your question by clicking on "Mark as Best Answer"

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Do we pay tax on forfeited dependent care FSA?

So if I understand correctly, the forfeited amount will be not only lost due to the rule of use it or lose it, but also becomes taxable. That does not seem reasonable. Do I misunderstand? Thank you.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Do we pay tax on forfeited dependent care FSA?

I edited my answer above. A forfeited amount is not taxed, only funds that were not used for Dependent Care are.

First, make sure your employer doesn't have a grace period you can use for the funds. Not all plans have this, so you will have to check.

For employees, the main downside to an FSA is the use-it-or-lose-it rule. If the employee fails to incur enough qualified expenses to drain his or her FSA each year, any leftover balance generally reverts back to the employer. However, there are two exceptions to the use-it-or-lose-it rule.

An FSA plan can allow a grace period of up to 2 1/2 months. For a calendar-year FSA plan, that gives employees up to March 15 of the following year to incur enough expenses to soak up their unused FSA balances from the previous year (most FSA plans are operated on a calendar-year basis).

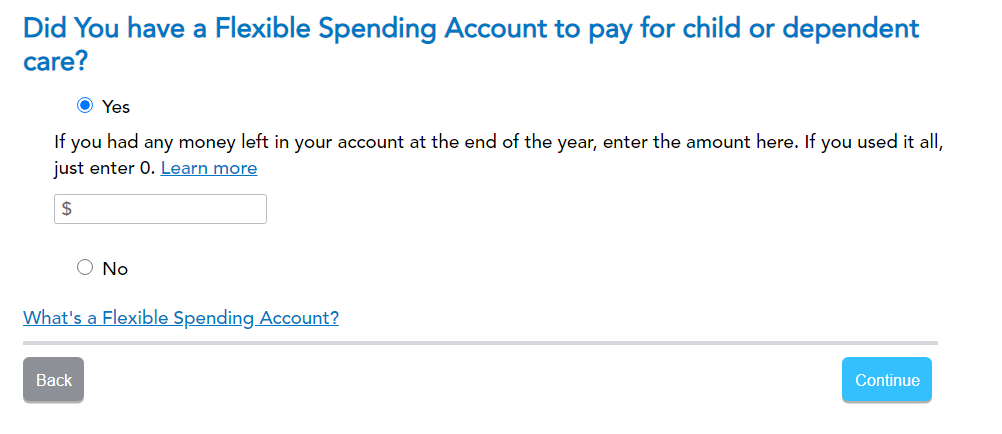

If you don't have the grace period, you will see this screen after you enter your W2-

You will want to say what amount you forfeited here. If you enter the forfeited amount here, you will not be taxed on it.

**Mark the post that answers your question by clicking on "Mark as Best Answer"

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Do we pay tax on forfeited dependent care FSA?

Like it or not if you did not use up all the FSA funds then not only can they be forfeited but the unused portion is added back into the wages and is taxed as if you never put it in the FSA at all.

The only good news is that the money put in the FSA account escaped FICA taxes as well and you do not need to pay them on the forfeited amount ... only the fed (and maybe state) taxes.

For instance ... if you set aside the max of $5000 in the FSA then that amount did not have the employee's share of the FICA taxes withheld which is $5000 x 7.65% = $382.50 of taxes saved on the W-2 ... but the $5000 has to be added back to the wages in box 1 which shows up on the form 1040 line 1.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Do we pay tax on forfeited dependent care FSA?

So I am in the same situation.

In our situation we had an unfortunate series of events and had to forfeit $1500 fro. Our DCSA.

So now we not only loose that money but we now get taxed and on top of that we do not qualify for a child tax credit, because of this "benefit".

Having a hard time understanding why this is even considered a benefit if you are in the middle of a tax bracket this is a bit scummy IMO

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Do we pay tax on forfeited dependent care FSA?

I exactly have the same problem and I'm seeing conflicting responses here. How can I be taxed for the forfeited amount in DCFSA? We will not only loose unused funds and also pay taxes on them

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Do we pay tax on forfeited dependent care FSA?

No, you are not taxed on your forfeited amount in DCFSA.

In the follow-up interview questions after you enter your W-2, you will reach the screen Did You have a Flexible Spending Account to pay for child or dependent care? And you are asked to enter the amount if you had any money left in your account at the end of the year.

Enter the amount that was forfeited in that box. Even though you might think that there's no money in the account because you forfeited it, if you click the Learn more link you'll see that it says:

"The money you put into your Flexible Spending Account (FSA) has to be used by the end of plan year or you forfeit it, meaning you don’t get it back. Some employers let you carry left over money into the next year, but this doesn’t happen very often.

We’re asking for the amount of money you either forfeited because you didn’t use it by the end of the plan year, or the amount your employer is going to allow you to carry over into next year’s FSA (uncommon). Money that was not reimbursed (because you paid for something that didn’t count as a qualified expense) counts as being forfeited and should be included.

Don’t include any amounts you expect to be reimbursed at a future date."

If you enter the amount that you forfeited in this section, you will not be taxed on it.

**Mark the post that answers your question by clicking on "Mark as Best Answer"

- « Previous

-

- 1

- 2

- Next »

Still have questions?

Make a postGet more help

Ask questions and learn more about your taxes and finances.

Related Content

Kathyyy

Returning Member

zzz8881

Returning Member

stratobrad84

Returning Member

StevenFff24

Returning Member

sm7393

New Member