- Community

- Topics

- Community

- Topics

- Community

- :

- Getting started

- :

- News & announcements

- :

- Filling Out Your W-4? Dust Off Your Crystal Ball!

Filling Out Your W-4? Dust Off Your Crystal Ball!

- Subscribe to RSS Feed

- Mark as New

- Mark as Read

- Bookmark

- Subscribe

- Printer Friendly Page

- Report Inappropriate Content

Since 2020, when the IRS changed the W-4 tax withholding form, many taxpayers (and professionals) have discovered that getting the proper amount of taxes withheld from paychecks is not an easy task. It’s no longer about how many “exemptions” you claim. Now you must know all of your numbers - what additional income you’ll have and your expected deductions too. As surprising as it sounds, it can be difficult to calculate your total income from all sources - let alone which deductions actually affect your tax refund.

Is your crystal ball polished up and ready to go? Let’s make some predictions!

As life events happen, you usually need to update your W-4 too. Perhaps you have a child that is leaving the nest or you paid off the mortgage that bumped your itemized deductions to an amount higher than the Standard Deduction. Maybe you stopped contributing to your employer’s retirement plan (hopefully this didn’t happen) or you had some other life-changing circumstance that affected your finances. Those things can absolutely increase the amount of taxes you owe, or reduce your refund.

But, how much more will you owe? Which new tax bracket will you be in? Do you file Single now instead of Head of Household? How much did that mortgage actually help you - in tax dollars? Are you losing a tax credit next year? Yep - this is where that crystal ball comes in handy!

It’s complex because taxes are complex.

There are multiple tax brackets and your income and filing status can affect the ability to claim specific deductions or credits. What this means is that only $1,000 of fewer deductions (or increased income) can result in additional taxes ranging from $100-$370 or more! And “credits” are an entirely different category of tax benefit. If you are no longer able to claim $1,000 in a tax credit, you could owe an additional $1,000 in taxes. That’s right, tax credits are usually dollar-for-dollar tax savings.

So, when it’s time for you to update your W-4, there is no possible way for it to be exactly correct - unless your predictions are 100% accurate and your crystal ball is not glitching out on you!

The W-4 form itself is nearly impossible for most people to complete. Step 1 in filling out the form is self-explanatory as it’s all personal info in that section. Steps 2-4 are a bit more challenging. If you enjoy a bit of confusion and being referred to various worksheets to complete (what should be) a simple tax withholding form, you can look at the actual W-4 form and instructions. As you will see, the W-4 form is more than complex for a “non-mathy” type of person.

The solution!

Can’t quite follow those instructions - or maybe you didn’t quite get that crystal ball cleaned up? No worries! TurboTax has you covered with the most amazing W-4 Calculator! It’s so easy and accurate. In the end it will even tell you what to put on each line of the W-4. And it’s 100% free to use. Yay!!

Oh, and here’s a little tip if you expect all of your income and deductions to be roughly the same this year:

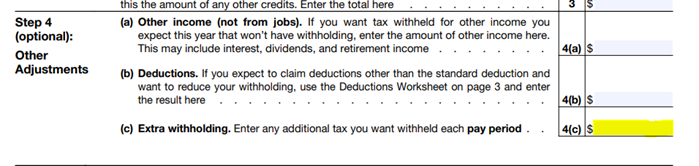

Take a look at your prior year tax return. If you had a balance owed last year, divide that number by the number of pay periods left for this year. Then on line 4(c) of the W-4 form enter at least that amount. Unless something dramatic changes with your income and deductions, you should be pretty close to having the correct amount withheld.

For example: If you owed $2,000 more in taxes and have 10 more “pay periods” this year, that’s $2,000/10 = $200 that would go on line 4(c).

And if you want a refund - just pad that line 4(c) with a dollar amount that goes above and beyond what you expect would be your additional taxes owed.

Don’t know where to start? That’s okay! You can drop some numbers into the TurboTax TaxCaster to get an idea of how much your refund will be, or how much you’ll owe. Then, adjust your W-4 accordingly.

Are you still confused about what a W-4 is and why it’s needed? This article explains exactly what a W-4 is, what it does, and why it’s needed.

And, for anything else you want to know about the W-4 form, the following are great resources to help you out!

How To Estimate Federal Withholding

Form W-4 and Your Take-Home Pay

The W-4 Form Changed in Major Ways — Here's What's Different

- Conserve Energy - Get Tax Credits!

- Win $100! Tax Credit Sweepstakes

- Know Your Tax Lingo: Self Employed & Gig Workers

- Win $100! Self-Employed & Gig Workers Sweepstakes

- Filing Early: Should I or Shouldn’t I

- Win $100! Early Filers & First-Time Filers Sweepstakes

- Tax Questions: Who's Your Expert?

- Crypto Investors: Your Lives Just Changed!

- Win 100! Cryptocurrency Sweepstakes

- Community Chatter: This or That?